Homeowners Insurance in and around Albany

Albany, make sure your house has a strong foundation with coverage from State Farm.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Committing to homeownership is an exciting time. You need to consider home layout neighborhood and more. But once you find the perfect place to call home, you also need fantastic insurance. Finding the right coverage can help your Albany home be a sweet place to be.

Albany, make sure your house has a strong foundation with coverage from State Farm.

The key to great homeowners insurance.

State Farm Can Cover Your Home, Too

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your largest asset safe. You’ll get a policy that’s adjusted to correspond with your specific needs. Luckily you won’t have to figure that out by yourself. With empathy and outstanding customer service, Agent Nicolas Morales can walk you through every step to generate a plan that shields your home and everything you’ve invested in.

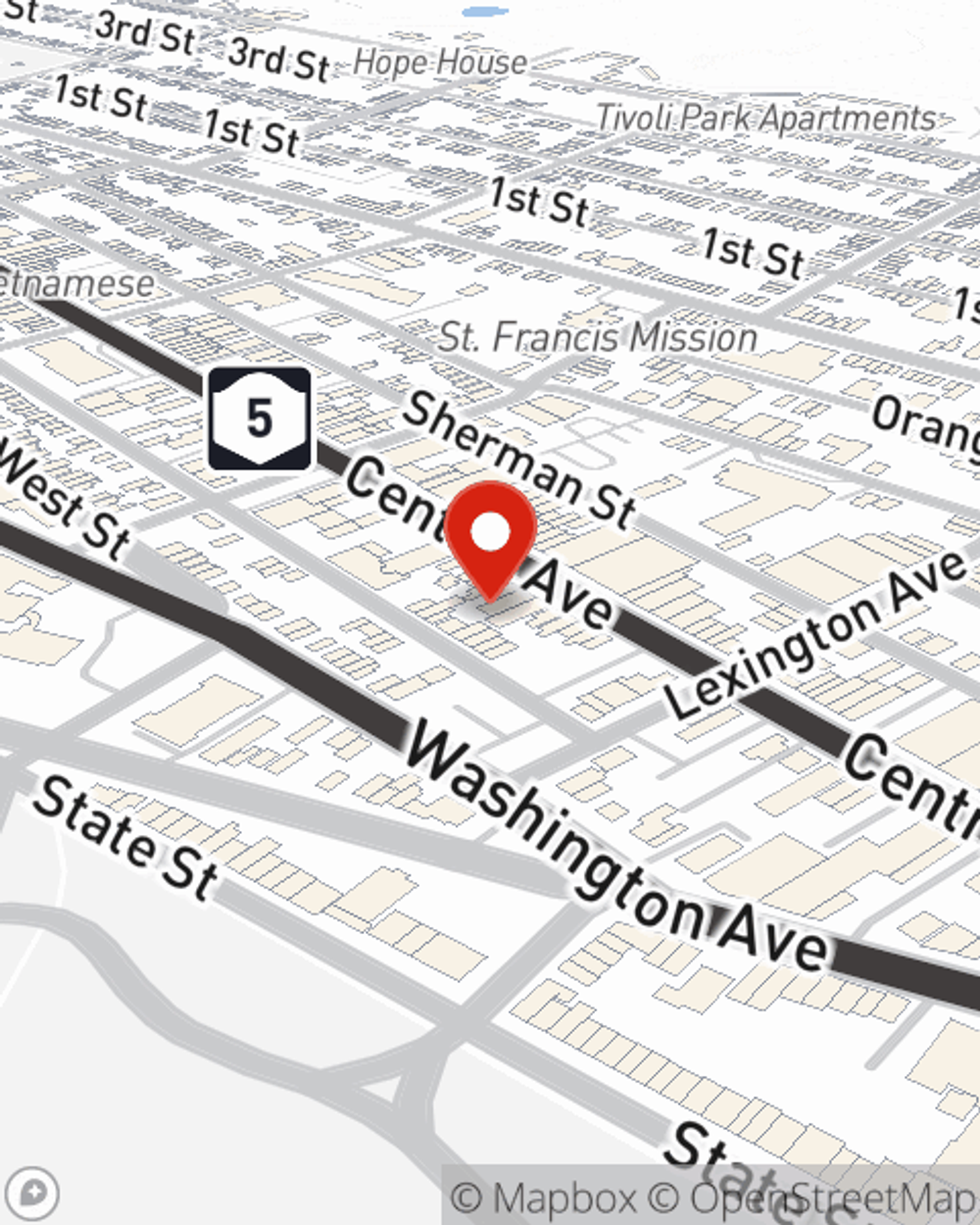

More homeowners choose State Farm® as their home insurance company over any other insurer. Albany homeowners, are you ready to find out what a State Farm policy can do for you? Contact State Farm Agent Nicolas Morales today.

Have More Questions About Homeowners Insurance?

Call Nicolas at (518) 427-2886 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.

Nicolas Morales

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.